Investment Risks: All investments involve risk - precious metals are no exception. The value of a precious metal product is affected by many economic factors, including the current market price of bullion, the perceived scarcity of the item and other factors. Some of these factors include quality, current demand and general market sentiment. Therefore, because the value of precious metals can go down as well as up, investing in them may not be suitable for everyone. You should understand precious metals well, and have adequate cash reserves and disposable income before considering a precious metals investment.

Bullion

Bullion is struck in silver, gold, platinum, and palladium and can be in the form of rounds, coins, or bars.

The value of the bullion is determined by its weight and spot price in the precious metals market.

These two factors are major reasons for those who want to purchase precious metals as an investment to diversify their portfolio.

The value of the bullion is determined by its weight and spot price in the precious metals market.

These two factors are major reasons for those who want to purchase precious metals as an investment to diversify their portfolio.

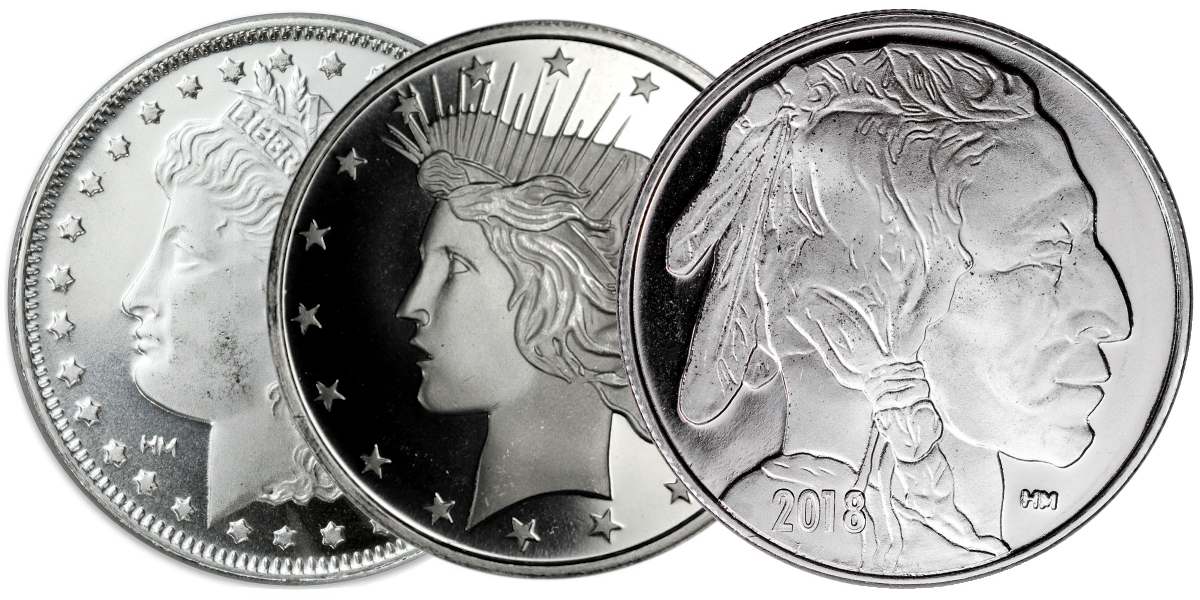

Rounds & Bars

Rounds and bars are bullion products that are privately minted from various companies around the world.

These products are the least expensive way to acquire precious metals due to the low premium they carry. For that reason, they are usually the choice among early investors to accumulate silver and/or gold quickly and at good price point without breaking the bank.

However, bars and rounds do not have the collectible value like coins do because they are produced by various mints.

Rounds and bars are bullion products that are privately minted from various companies around the world.

These products are the least expensive way to acquire precious metals due to the low premium they carry. For that reason, they are usually the choice among early investors to accumulate silver and/or gold quickly and at good price point without breaking the bank.

However, bars and rounds do not have the collectible value like coins do because they are produced by various mints.

Coins

Similar to rounds by shape only, coins display a face value and are produced by government mints.

Although coins do have a face value and can be used as currency, the real value is in the metal itself.

Example the American Silver Eagle has a face value for $1 and the Canadian Maple Leaf for $5. But the spot price of silver is $15 as of 8/11/15. So would you really use these coins for their face value? Probably not.

Coins carry a higher premium but have greater collectible and resale value for investors and collectors.

Similar to rounds by shape only, coins display a face value and are produced by government mints.

Although coins do have a face value and can be used as currency, the real value is in the metal itself.

Example the American Silver Eagle has a face value for $1 and the Canadian Maple Leaf for $5. But the spot price of silver is $15 as of 8/11/15. So would you really use these coins for their face value? Probably not.

Coins carry a higher premium but have greater collectible and resale value for investors and collectors.

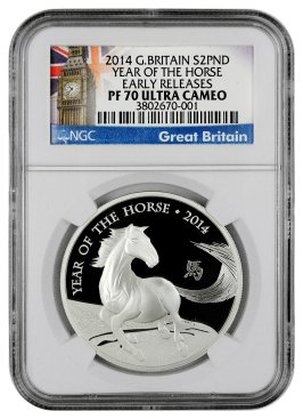

Numismatic Coins

|

Numismatics is the collection and/or study of coins or objects that was used as money.

Numismatic coins have various values that determines their price: rarity, mint mark, dates, and condition. These types of coins carry a low mintage which in the collector's market make them highly sought after. Another factor to consider is that coin collectors are always looking for the exceptional like firsts; limited editions and exclusivity. The future value of a numismatic coin is also based on supply and demand in the collectors market. Therefore the premiums are substantially higher for numismatic coins than bullion coins. |

Understanding Money

|

|

|

|

Understanding The Sheldon Grading System:

Grading Scale: Numismatic coins use The Sheldon Grading Scale to determine the grade of the coin ranging from 1 to 70 (70 is a perfect coin) Coins with no wear at all are alternately referred to as Uncirculated (Unc.), Brilliant Uncirculated (BU), and Mint State (MS). When a numerical grade is assigned to an uncirculated coin, it goes along with the abbreviation MS, such as MS-60. Uncirculated (MS-60, 61, 62): An uncirculated coin with noticeable deficiencies, generally either an overabundance of bagmarks, a poor strike, or poor luster. Although most price guides will give a price for coins in MS-60 condition, in many cases this is a very unusual grade, with typical uncirculated pieces often grading somewhere in the MS-62 to MS-64 range depending on the series. Select Uncirculated (MS-63): An uncirculated coin with fewer deficiencies than coins in lower uncirculated grades. In general, this will be an uncirculated coin with relatively ordinary eye appeal. Select Uncirculated is sometimes used to refer to a coin grading MS-62. Choice Uncirculated (MS-64): An uncirculated coin with moderate distracting marks or deficiencies. These coins generally have average to above average eye appeal. Choice Uncirculated is sometimes used to refer to a coin grading MS-63. Gem Uncirculated (MS-65, 66): An uncirculated coin with only minor distracting marks or imperfections. At this point, mint luster is expected to be full, although toning is quite acceptable. Superb Gem Uncirculated (MS-67, 68, 69): An uncirculated coin with only the slightest distracting marks or imperfections. Toning is still quite acceptable and in these grades will usually be pleasing. Many circulating coins even of relatively recent dates are quite rare in such lofty grades, although modern bullion coins and commemorative s are often found in grades as high as MS-69. Perfect Uncirculated (MS-70): An utterly flawless coin. |

Numismatic Coin Terminology Cameo: A coin with frosted appearance Circulated - A coin which has actually been used as money and shows some degree of wear Commemorative: A coin with design struck in honor of some important, current event or historical famous person or special anniversary Obverse: The heads side of a coin with portrait of national leader Reverse: Back side or tails side of a coin Mint State: An un-circulated coin in the same condition as when it was originally minted showing no signs of wear. Indicated on a graded coin as MS Specimen: A coin minted for special sets using a different striking method. Not in circulation. Indicated on a graded coin as SP in place of MS Proof Coin: Coins that are struck with greater pressure than normal using specially polished dyes to make the design more highly polished or mirror-like; it is indicated on a graded coin as PF or PR in place of MS Proof Like: A coin minted for collectors using polished blanks rendering a polished coin with cameo frosted highlights. Indicated on a graded coin as PL in place of MS Bullion: precious metals such as silver and gold in the form of bars, ingots, plate, and other items. Certified coin: coins that has been authenticated and graded by an independent, third party professional coin grading service and encased in a plastic holder. Intrinsic value: the melt value of the precious metal contained in a coin. Slab: nickname for a hard plastic case used by professional grading services to encapsulate authenticated and graded coins. Sterling silver: silver that is .925 Junk silver: Pre-1965 circulated 90 % silver dimes,quarters, half dollars, and dollars (40% silver half dollars of 1965-1969) that are valuable for their silver content. |