Investment Risks: All investments involve risk - precious metals are no exception. The value of a precious metal product is affected by many economic factors, including the current market price of bullion, the perceived scarcity of the item and other factors. Some of these factors include quality, current demand and general market sentiment. Therefore, because the value of precious metals can go down as well as up, investing in them may not be suitable for everyone. You should understand precious metals well, and have adequate cash reserves and disposable income before considering a precious metals investment.

Assets

An asset is a resource with economic value that can be owned and is expected to provide a future benefit. (Investopedia)

There are many assets in the investor world: Cash, Precious Metals, Collectibles, Bonds, ETF's, Mutual funds, Real Estate, Stocks, Foreign Currencies, and Commodities. Now that we know what an asset is and the different ones that are out there, lets see the reasons why investors consider silver and gold into their plans or agenda.

There are many assets in the investor world: Cash, Precious Metals, Collectibles, Bonds, ETF's, Mutual funds, Real Estate, Stocks, Foreign Currencies, and Commodities. Now that we know what an asset is and the different ones that are out there, lets see the reasons why investors consider silver and gold into their plans or agenda.

Silver & Gold

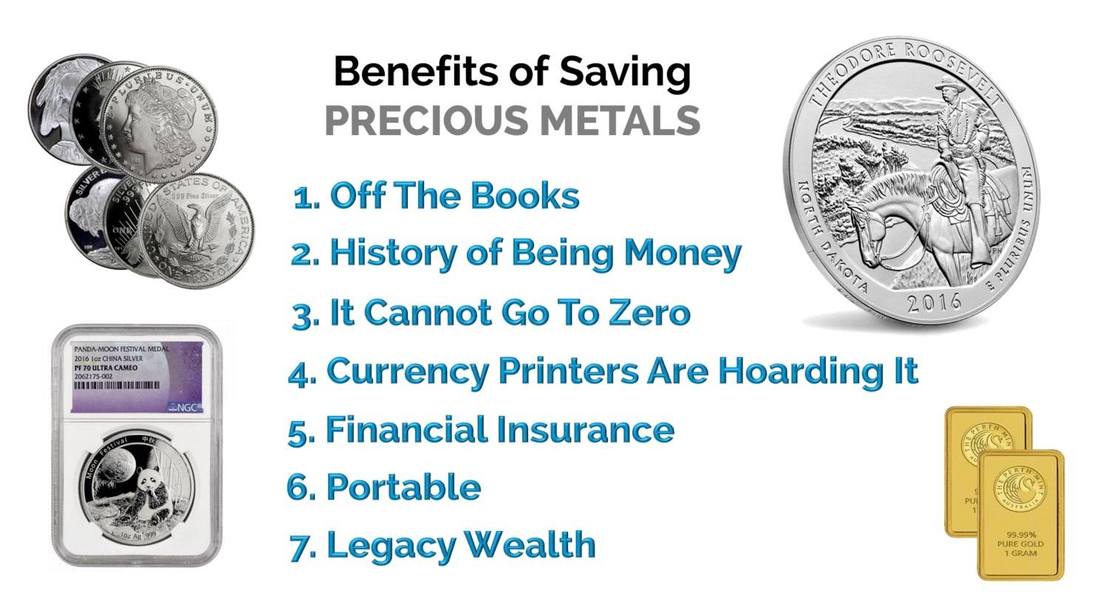

For over 5,000 years, Gold & Silver have been considered as money among civilizations. Investors and collectors have owned Silver & Gold for a variety of reasons:

You can the research the history of Silver and Gold in books or online to further your education on these precious metals.

Don't forget: The future value of bullion coins and bars are based solely on their gold or silver content on the day the holders want to sell them.

Gold and silver is not about making money, but preserving your wealth outside from the debt base paper system we have today. Having tangible assets that can maintain its value is the key to protecting your financial health in the current markets. It's important to get educated concerning the monetary system so you can protect yourself and help others.

If you are looking to buy Silver and Gold, call me to get the best possible price for amount you want to spend.

Ricardo Wright

(919) 748-0079

- Silver & Gold are precious metals that financial investors recommend as a diversification strategy in uncertain markets

- Silver & Gold are recognized and traded as a commodity worldwide

- Silver & Gold are recognized as a monetary and financial asset worldwide

- Silver & Gold can be passed down to loved ones and future generations

- Silver & Gold are used in several products such as computers, cell phones, water filters (to name a few) due to their unique properties .

You can the research the history of Silver and Gold in books or online to further your education on these precious metals.

Don't forget: The future value of bullion coins and bars are based solely on their gold or silver content on the day the holders want to sell them.

Gold and silver is not about making money, but preserving your wealth outside from the debt base paper system we have today. Having tangible assets that can maintain its value is the key to protecting your financial health in the current markets. It's important to get educated concerning the monetary system so you can protect yourself and help others.

If you are looking to buy Silver and Gold, call me to get the best possible price for amount you want to spend.

Ricardo Wright

(919) 748-0079