History

Silver & Gold has been used as a medium of exchange across the globe long, long ago. If you study U.S. history, you will learn that the Founding Fathers supported this idea so much that it was even put into the Constitution: "No State shall make anything but gold and silver coin, a tender in payment of debts.” The United States was using the "gold standard" and later created "demand notes" for the real money in the Treasury vaults. However, things changed concerning silver and gold as money.

In 1965, Congress passed the Coinage Act which eliminated silver from all dimes, quarters, & half-dollars then replaced it with copper and nickel. The reason for this was due to the rising price of silver-which led to coin shortages. In 1971, the country was forced to abandon the gold standard when the other Nations were turning in their certificates for the gold in the US Treasury, which was bringing our gold supply down. President Nixon took the US off of the gold standard and created a fiat currency through out the world.

In 1965, Congress passed the Coinage Act which eliminated silver from all dimes, quarters, & half-dollars then replaced it with copper and nickel. The reason for this was due to the rising price of silver-which led to coin shortages. In 1971, the country was forced to abandon the gold standard when the other Nations were turning in their certificates for the gold in the US Treasury, which was bringing our gold supply down. President Nixon took the US off of the gold standard and created a fiat currency through out the world.

Inflation

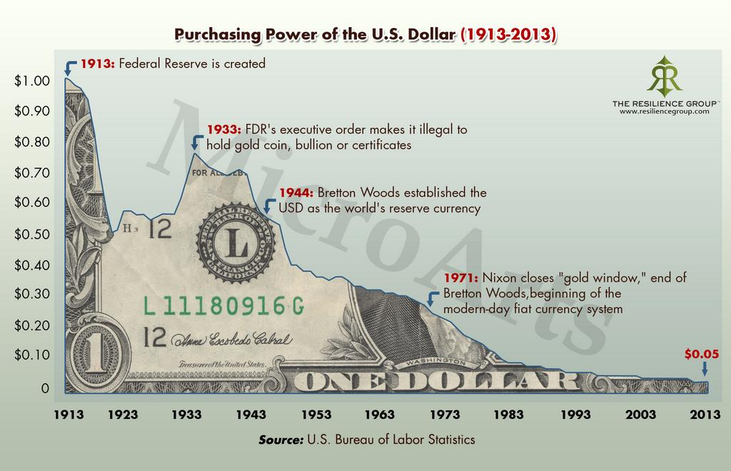

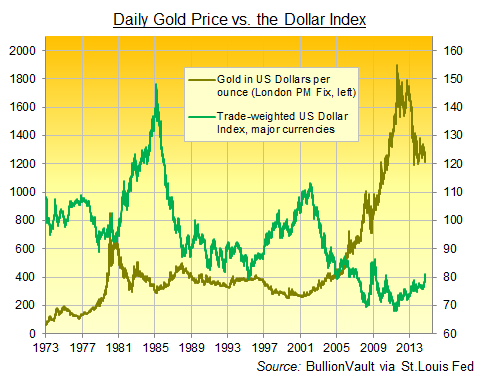

Because the U.S. is no longer on the gold standard, the dollar has been steadily losing its purchasing power since 1913. While all of our daily necessities (milk, gas, oil, etc.) are the same portion, it costs more to buy because of the decreasing value of the dollar. The government keeps printing more dollars, which is devaluing the money in your bank accounts. And if this isn't enough to make you open your eyes, it’s also raising the national debt to an unsustainable amount that can NEVER be paid back. With the currency falling apart, an economic collapse is bound to occur. For reasons like these, people are studying and equipping themselves with real money: gold and silver.

The Uses Of Silver & Gold

Silver & Gold is mostly known for jewelry and currency, but are also used as industrial metals as well. Silver and gold are present in batteries, electronics, photography film, water purification systems, ointments, just to name a few. They are also used as a hedge against future economic collapse or a devaluing currency. As the world’s industrial demand for these precious metals rises, their supply is decreasing rapidly...

|

|

|

Now What?As people grow weary of the financial crisis, they are beginning to look for ways to protect themselves against it. Whether you have a survivalist mentality to store silver/gold for everyday items or an investor's mentality to protect other paper assets, these precious metals are still considered to be money and is accepted worldwide. As you gather more information about the past and present economy, study precious metals to see if this is right for you. There are tons of books and websites that can help you on your journey to learn more about silver and gold.

|

|

Investment Risks: All investments involve risk - precious metals are no exception. The value of a precious metal product is affected by many economic factors, including the current market price of bullion, the perceived scarcity of the item and other factors. Some of these factors include quality, current demand and general market sentiment. Therefore, because the value of precious metals can go down as well as up, investing in them may not be suitable for everyone. You should understand precious metals well, and have adequate cash reserves and disposable income before considering a precious metals investment.